Matthew Tominc

Chief Investment Officer

Welcome

We’re pleased to release Conscious Investment Management’s fifth annual impact report, which summarises our investing activities, lessons learned and the positive impact that the portfolio has had over the 2025 financial year.

Highlights in this year’s report include a focus on investing in social and affordable housing under the Housing Australia Future Fund program – where we hope to help create ~2,000 new social and affordable housing outcomes over the coming years, a new biodiversity investment – which is expected to plant over 900,000 native trees and shrubs, and broad impact updates across the portfolio.

We encourage you to read this year’s report, which we’ve highlighted on this site. In our report, you’ll find deeper insights into CIM’s initiatives, along with reflections on our ongoing journey - and the lessons we continue to learn - in creating meaningful impact alongside our partners and with the support of our investors.

Cover Artist: Gayan Batawala. Painting of CIM social and affordable housing investments in Box Hill, Melbourne, Vic

Impact Highlights

Image taken at the Greening Australia tree planting event at Greening Australia Native Seed Centre, NSW

CIM by the numbers

$424M

Funds Under Management

$528M

of capital dedicated to impact

~$25M

of financing provided for assets intended to be owned and operated by our Impact Partners indefinitely

>800

investors incorporating impact investments in their portfolios

13

Impact Partners supported

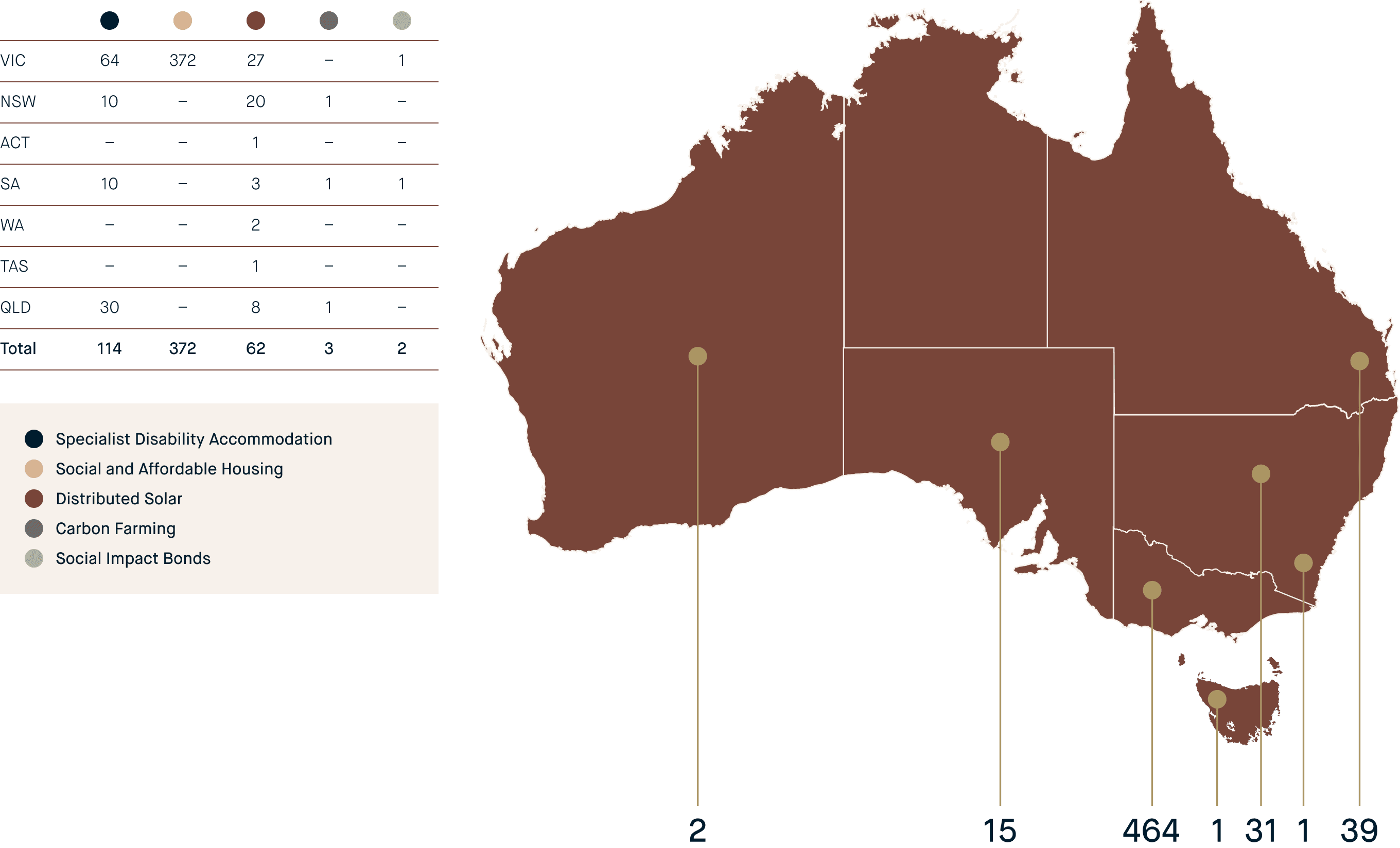

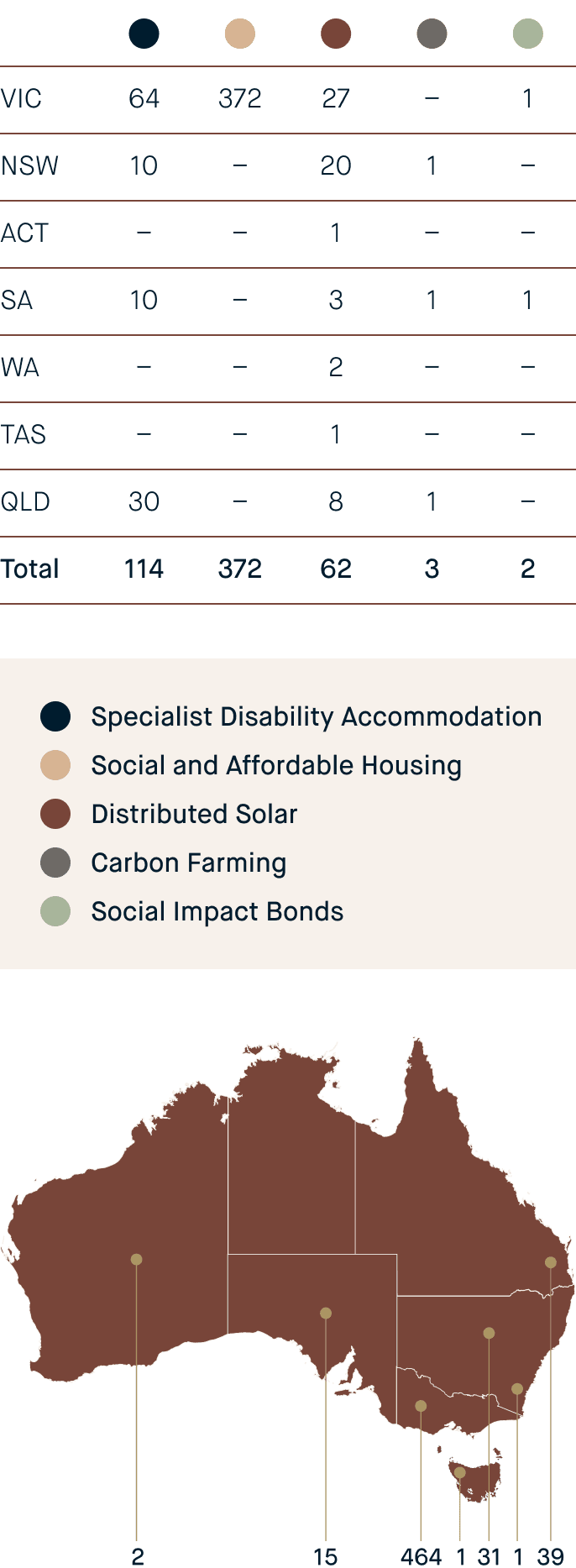

Asset Locations

This includes all assets financed by CIM managed funds, including the investment into portfolios of distributed solar assets which have been exited.

IMN Scoring

| Asset | IMN Score1 | |

| Carbon Farming | 4.6 | Contributes to Solutions |

| Distributed Solar | 4.3 | Contributes to Solutions |

| Social Impact Bonds | 4.7 | Contributes to Solutions |

| Specialist Disability Accomodation | 4.4 | Contributes to Solutions |

| Victorian Social and Affordable Housing | 4.8 | Contributes to Solutions |

| Youth Housing | 4.6 | Contributes to Solutions |

| Housing Australia Future Fund Program | 4.7 | Contributes to Solutions |

1Impact Management Norms. Discussed in detail in the 2025 Impact Report.

- 0-2: Act to avoid harm = score between 0 and 2

- 2.1-3.4: Benefit stakeholders = score between 2.1 and 3.4

- 3.5-5: Contribute to solutions = score between 3.5 and 5

About CIM

Conscious Investment Management is a dedicated impact investment fund manager. We were founded in 2019 with a vision for a fairer, more sustainable world where people and the planet thrive.

CIM Executive Team

Social and affordable housing investment in Maribyrnong, VIC

Our mission is to invest for positive impact and financial returns. We deliver impact investments that are authentic, accessible and scalable.

Our model involves investing in social and sustainability-focused assets, and managing these alongside our Impact Partners (the majority of which are not-for-profits). In this way, we can make financial investments, while ensuring assets are operated for tangible, positive impact.

We focus on investing in real assets across three impact themes:

1. Social Infrastructure

2. Environment and Climate

3. Health and Education

Our funds have invested capital in a range of sectors – including social and affordable housing, Specialist Disability Accommodation, renewable power, carbon farming and social impact bonds.

We believe that great impact investments are made, not found. Our team has experience across leading not-for-profits and institutional investment groups. This unique combination of team experience means we can bridge the impact and investment worlds, and manage the on-the-ground impact of our investments.

Corporate Sustainability

First Nations Carbon Farming Investment at Thargomindah Station, QLD

CIM team at the Greening Australia tree planting event at Greening Australia Native Seed Centre, NSW

The corporate sustainability of CIM itself is central to achieving our vision and mission. We recognise we must hold ourselves to the highest standards, and embed responsible practices into our broader business.

- CIM has been certified as a carbon neutral organisation by Climate Active since 2020.

- CIM launched its Innovate Reconciliation Action Plan earlier this year. CIM’s Innovate Reconciliation Action Plan reflects our commitment to move from reflection to action—building meaningful relationships, implementing structured initiatives, and embedding reconciliation into how we invest and operate.

Our Associations

- CIM is a signatory of the Operating Principles for Impact Management.

- In 2022, 2023 and 2024, Conscious Investment Management was assessed by Responsible Investment Association Australasia ("RIAA") as a Responsible Investment Leader, which demonstrates leading practice, using RIAA’s Responsible Investment Benchmark Report Australia Scorecard.

- The Conscious Investment Management Impact Fund (“CIMIF”) has been certified by the Responsible Investment Association Australasia as a ‘Sustainable Plus’ investment product,1 the highest possible classification.

Footnote 1: The Responsible Certification Program does not constitute financial product advice. Neither the Certification Symbol nor RIAA recommends to any person that any financial product is a suitable investment or that returns are guaranteed. Appropriate professional advice should be sought prior to making an investment decision. RIAA does not hold an Australian Financial Services Licence.

Social Infrastructure Impact Highlights

New Social and Affordable Housing Investment, Box Hill, VIC

Summary

CIM recognises that Australia has an inadequate supply of stable, appropriate and affordable accommodation, particularly for those on low incomes. Not having secure and appropriate accommodation is often a barrier to educational attainment, stable work, strong health and wellbeing, and family and community relationships.

To address this challenge, we seek to partner with leading Community Housing Providers and Government to fund the development and acquisition of dwellings for social and affordable tenants.

Sustainable Development Goals addressed:

Impact Metrics

372

social and affordable housing dwellings financed

~650

people expected to be provided housing

Highlight: CIM Social Housing Fund 2

New Social and Affordable Housing Investment, Box Hill, VIC

Over the past year, CIM has been focused on investments that scale Australian social and affordable housing through the Housing Australia Future Fund (HAFF). We reached final close on the Conscious Investment Management Social Housing Fund 2 in June 2025, with $181M of commitments to the fund and co-investment vehicles. CIM is looking to use these commitments to finance ~15-20 projects through the HAFF program or State equivalents, across six states and territories. If all projects are completed with CIM financing, it would represent over 1,500 new social and affordable dwellings, expected to provide housing to ~2,000 residents.1

Consistent with CIM’s model, these investments are structured with long-term (25-year) payments from Housing Australia, but importantly, put trusted Community Housing Providers (CHPs) front and centre.

CIM’s structuring approach prioritises ongoing housing outcomes. Projects are designed so that CHPs retain ownership of properties at the end of the HAFF term and housing stock remains within the community housing system, where it can continue to work for future generations.2

While using a different structure, CIM’s early investments into social and affordable housing in Victoria—now operational for over three years—have provided a valuable foundation, directly informing CIM’s HAFF strategy.

Footnote 1: These opportunities remain subject to ongoing discussions, due diligence, commercial negotiations and receipt of necessary approvals (including from Housing Australia). There can be no guarantee that any or all of these opportunities will proceed to completion or be invested in by any CIM-managed fund, or that the final number of dwellings financed or tenants housed will align with these expectations. Refer to “Important Information” on the final page of this report.

Footnote 2: These assets are acquired by our not-for-profit Impact Partners using funding provided by CIM’s managed funds. Our financing is structured using secured financing arrangements designed such that our financing is repaid over the investment period and the assets will remain with our Impact Partners thereafter. In the event the investment does not proceed as anticipated (for example, in a default scenario), there may be circumstances where the assets are transferred to other parties or financiers and CIM is unable to control the ongoing use of the assets. Further, while the intention is that Impact Partners will continue to use the assets for the same purposes following the investment period, CIM cannot control the use of the assets following its exit of the investment.

Environment and Climate Impact Highlights

Caddigat Road, a CIM financed site for biodiverse carbon farming, NSW

Summary

CIM recognises that Australia is facing a dual biodiversity and climate crisis. This is leading to species extinction, collapsing ecosystems, endangered vegetation communities and extreme weather events, which are impacting the health, wellbeing and financial security of many.

Sustainable Development Goals Addressed:

Impact Metrics

3

carbon farming projects financed

62

distributed solar assets financed

33,073

MWh of renewable energy generated

Greening Australia Partnership – New Investment

Greening Australia and CIM team at O'Kiltabie, a CIM financed site for biodiverse carbon farming SA

In January 2025, CIM made its second biodiverse environmental planting investment alongside environmental not-for-profit Greening Australia. CIM provided financing for the purchase of a 3,313-hectare property in South Australia for a property named “O’Kiltabie.” Greening Australia plans to plant ~900,000 native trees and shrubs on the property over 2026/27.

Restoration of the property is designed to contribute to the recovery of the critically endangered Drooping Sheoak Grassy Woodland on calcrete vegetation community, and to benefit a number of threatened bird and mammal species.

This investment builds on Greening Australia and CIM’s first project together – Caddigat Road – which was financed in 2024. In late October 2024, CIM invited investors to visit the property and meet the Greening Australia team. See via this link a video that provides an overview of the project and showcases the property that will be restored under the partnership.

Located near Elliston on the western Eyre Peninsula of South Australia, the area contains a mosaic of large, intact and contiguous stretches of bushland and cleared agricultural paddocks.

The project will restore a very large area of the critically endangered Drooping Sheoak Grassy Woodland on Calcrete vegetation community. It will also deliver benefits for other threatened species including the Malleefowl and a range of small woodland birds and mammals such as the Diamond Firetail, Little Long-tailed Dunnart and Pygmy Possum.”

In this year’s Impact Report, we have included an interview with Heather Campbell (CEO, Greening Australia) and Paul Della Libera (Executive Director, Greening Australia) that shares insights into Greening Australia’s work, our partnership and advice for other environmental groups looking to partner with private capital.

CIM’s structuring approach prioritises creating ongoing natural capital and biodiversity outcomes. Projects have 100-year permanence periods, and are designed so that Greening Australia and it’s community partners can maintain the reforested land – effectively creating new parkland that we hope exists for generations.1

Footnote 1: These assets are acquired by our not-for-profit Impact Partners using funding provided by CIM’s managed funds. Our financing is structured using secured financing arrangements designed such that our financing is repaid over the investment period and the assets will remain with our Impact Partners thereafter. In the event the investment does not proceed as anticipated (for example, in a default scenario), there may be circumstances where the assets are transferred to other parties or financiers and CIM is unable to control the ongoing use of the assets. Further, while the intention is that Impact Partners will continue to use the assets for the same purposes following the investment period, CIM cannot control the use of the assets following its exit of the investment.

Distributed Rooftop Solar Exit

Distributed Rooftop Solar Investment at Tweed Mall, QLD

In mid-2025, the CIM Impact Fund exited substantially all of its investment into a portfolio of distributed solar assets managed by Energy Bay, which were initially financed as part of the fund’s commitment to accelerating Australia’s transition to clean energy. Energy Bay is an energy infrastructure investment platform focused on deploying distributed renewable energy assets such as rooftop solar and embedded networks across commercial and industrial properties.

The acquirer of this portfolio shares our long-term vision for scaling renewable infrastructure. In accordance with CIM’s responsible exits process, this exit was made to a group that intends to continue investing in the portfolio by pursuing further project development and integration of battery energy storage systems alongside the existing solar assets.

This exit reflects CIM’s ongoing strategy of catalysing early growth in impact-aligned sectors. We have watched the evolution of the behind-the-meter solar sector since we first begun investing, and this is CIM’s second exit in the space. In addition to financial returns, this exit has focused on ensuring that the environmental impact of CIM’s initial investment is preserved and amplified into the future.

Health and Education Impact Highlights

Specialist Disability Accommodation Investment at Maribyrnong, VIC

Summary

Health and education is a fundamental human right and an investment sector amenable to profit-seeking capital.

Historically, the provision of housing for people with disability has resulted in several challenges, including insufficient capacity, aging housing stock that is no longer fit for purpose, and outdated care models.

Since 2020, CIM has been investing in Specialist Disability Accommodation on the premise that improving housing accessibility for individuals with more complex care needs can in-turn improve their wellbeing, self-worth, and ability to take greater control of their lives.

Sustainable Development Goals addressed:

Impact Metrics

114

Specialist Disability Accommodation apartments financed

293

primary school children supported to engage in school

39

children reunited with their families

Liverty Housing Partnership – Tenant Case Study

CIM has been investing in the Specialist Disability Accommodation (SDA) sector since February 2020, partnering with Liverty Housing to deliver high-quality, long-term accommodation in underserved areas of SDA. The outcomes of Liverty Housing tenants are independently measured by La Trobe University using the Home and Living Outcomes Framework.

This year, CIM is proud to share Louis’ story, a tenant one of the SDA apartments called Gadsden, financed by CIM. See a snapshot below, with the full story in this year’s longer form Impact Report.

Specialist Disability Accommodation Investment in West Melbourne, VIC

Tenant Story

Louis is a man that has lived with Multiple Sclerosis (MS) for nearly 20 years. Living with MS has been a significant adjustment, and over time, he slowly watched things he valued about himself slip away.

Moving into SDA was a big deal; not just finding the right home but also navigating the NDIS world and trying desperately to learn all that he could about a really complex system. Louis was terrified and anxious in the months leading up to his move, but with the help of Liverty Housing, was able to work through the maze.

Tenant Specialist Olivia spent a lot of time getting to know Louis – who he was as a person, his support needs, and what a ‘good home’ looked like for him. She spent time talking through the endless NDIS jargon and explaining the system and process. Louis and Olivia also had many conversations about all of the aspects of SDA living and explored what transitioning to this next phase of his life would look like.

Since moving in, Louis has absolutely blossomed. He reports that his anxiety is almost gone, and he is learning so much from his Gadsden neighbours about moving through the disability space and maintaining a sense of dignity and self-direction.

Louis has also had enormous praise for Olivia and says that her level of expertise across all facets of disability helped him enormously. She was able to explain and guide him step-by-step through all the “…various bits and pieces”. In particular, he valued that Olivia ‘held space’ for him, and felt that her lived experience was a real benefit.